This morning April 21, before Wall Street opening, Harley-Davidson Inc posted a higher quarterly net profit, but lowered its sales forecast for 2015 citing aggressive price discounting by its competitors. After the results were announced, at 8.45 a.m. ET shares of Harley-Davidson (HOG) fell 7.80% in pre-market trading

This morning April 21, before Wall Street opening, Harley-Davidson Inc posted a higher quarterly net profit, but lowered its sales forecast for 2015 citing aggressive price discounting by its competitors. After the results were announced, at 8.45 a.m. ET shares of Harley-Davidson (HOG) fell 7.80% in pre-market trading

The company’s results were aided by cost controls and a lower tax rate, which helped offset lower sales and the impact of a strong U.S. dollar on its overseas revenue. Harley-Davidson reported net income of $269.9 million or $1.27 per share in the first quarter, up 1.5 percent from $265.9 million or $1.21 per share a year earlier. Analysts had expected earnings per share for the quarter of $1.25. Revenue for the quarter dipped to $1.67 billion from $1.73 billion a year earlier. That came in above analyst expectations of $1.58 billion.

The company’s results were aided by cost controls and a lower tax rate, which helped offset lower sales and the impact of a strong U.S. dollar on its overseas revenue. Harley-Davidson reported net income of $269.9 million or $1.27 per share in the first quarter, up 1.5 percent from $265.9 million or $1.21 per share a year earlier. Analysts had expected earnings per share for the quarter of $1.25. Revenue for the quarter dipped to $1.67 billion from $1.73 billion a year earlier. That came in above analyst expectations of $1.58 billion.

In the first quarter 1015, Harley-Davidson’s worldwide retail sales fell 1.1 to 56,661 motorcycles from 57,415 in the first quarter of 2014. Sales in its key U.S. market fell 0.7 percent to 35,488 from 35,730 motorcycles.

In the first quarter 1015, Harley-Davidson’s worldwide retail sales fell 1.1 to 56,661 motorcycles from 57,415 in the first quarter of 2014. Sales in its key U.S. market fell 0.7 percent to 35,488 from 35,730 motorcycles.

In a statement chief executive office Keith Wandell said that given the company’s retail results, and “ongoing, increased levels of aggressive competitive discounting” in the U.S. market “we are taking the precautionary step of lowering our estimated growth rate for full-year motorcycle shipments.” Harley-Davidson said it now expects motorcycle shipments to grow approximately 2 percent to 4 percent in 2015, down from its previous forecast of approximately 4 percent to 6 percent growth. In the second quarter, the company expects to ship between 83,000 to 88,000 motorcycles, down from 92,217 shipped in the same quarter in 2014.

![]() Retail Harley-Davidson Motorcycle Sales

Retail Harley-Davidson Motorcycle Sales

Worldwide retail sales decreased 1.3 percent compared to last year’s first quarter. Dealers worldwide sold 56,661 new Harley-Davidson motorcycles in the first quarter of 2015 compared to 57,415 motorcycles in the year-ago quarter.

In the U.S., dealers sold 35,488 new Harley-Davidson motorcycles in the quarter, down 0.7 percent compared to sales of 35,730 motorcycles in the year-ago period.

In international markets, dealers sold 21,173 new Harley-Davidson motorcycles during the quarter compared to 21,685 motorcycles in the year-ago period, with unit sales down 1.1 percent in the Asia Pacific region and 5.6 percent in the EMEA region and up 0.3 percent in the Latin America region and 5.7 percent in Canada.

![]() Harley-Davidson Motorcycles and Related Products Segment Results

Harley-Davidson Motorcycles and Related Products Segment Results

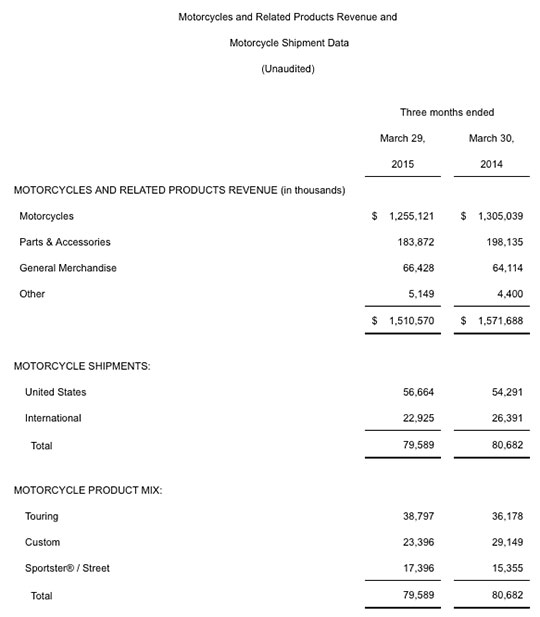

Operating income for the Motorcycles and Related Products segment (the Motorcycles segment) was $345.5 million in the first quarter of 2015 compared to operating income of $347.7 million in the year-ago period. Operating income in the quarter was primarily impacted by unfavorable foreign currency exchange, partially offset by strong productivity gains.

Revenue from sales of motorcycles to dealers and distributors was $1.26 billion, compared to revenue of $1.31 billion in the year-ago period. The company shipped 79,589 motorcycles worldwide during the quarter compared to shipments of 80,682 motorcycles in the year-ago period.

Revenue from motorcycle parts and accessories was $183.9 million during the quarter compared to $198.1 million in the year-ago period. Revenue from general merchandise, which includes MotorClothes® apparel and accessories, was $66.4 million compared to $64.1 million in the year-ago period.

![]() Financial Services Segment Results

Financial Services Segment Results

Operating income from financial services was $64.7 million in the first quarter of 2015 compared to $63.2 million in last year’s first quarter. First-quarter financial services results reflect favorable net interest and higher non-lending income, partially offset by increased provision for credit losses.

Harley-Davidson is revising its full-year guidance for motorcycle shipments, reflecting its commitment to manage supply in line with demand, and now expects to ship 276,000 to 281,000 motorcycles to dealers and distributors worldwide in 2015, an approximate 2 percent to 4 percent increase from 2014.

![]() Income Tax Rate

Income Tax Rate

For the first quarter of 2015, Harley-Davidson’s effective tax rate was 34.4 percent compared to 35.0 percent in the year-ago quarter. The company continues to expect its full-year 2015 effective tax rate to be approximately 35.5 percent.

Harley feeling the heat from Indian, Victory, Triumph, Royal Enfield…

This is how if should be. The days when you had to enter a lottery to try to win the opportunity to buy an over MSRP bike with zero perks is over.

Competition and alternatives. It’s good to be the king.

Wake up call for Harley. Competition is there.

Yes …. but to see the real picture … look at the companies total M/C sales YTD versus the combined total of P-V-I * , the Japanese Cruisers as well as Triumph’s ‘ big rigs ‘ ..

The fact is … despite a bit of competition …. which may or may not last [ all bets are … a good part of the competition won’t last past 2020 ] … and you’ll see ;

The King … is still the King . A little slimmer perhaps . But still ruling peoples hearts and minds .. the roost [ as well as the roads ] … with an iron fist I might add .

* A short hand abbreviation for Polaris / Victory / Indian … just to be clear to the pedantic amongst us and to put aside any potential confusion 😉

TJ Martin who knows the future of motorcycling has talked. Problem is, he is not an expert. Just wants to look like one.

Competition is good! Over time, It will contribute to improved product at more reasonable prices.

TJ Martin. I would suggest exchanging your handkerchief to a beach towel. When you purchase your burial lots get two one for you and one for the other king.

Gerry … and you know this …. why ? Seriously … you have no clue who or what I am never mind what I know . Suffice it to say though … if you did know what I know … you’d of been comfortably retired ever since age … err … 52 as well

As to fuji … a bit of a nonsensical response …. at best ! Might I suggest exchanging your attempts at witty albeit somewhat veiled insults for say … a relevant and fact based response ? To be blunt … wit doesn’t seem to be in your skill set .

TJ Martin. So, why don’t you tell us who you are and what you know? Usually people talking like you hide behind their computer because they are not who they pretend. By the way, can you write in correct English with the right punctuation? Quite difficult to understand your narrative.

This is getting good. I’m pulling up a lawn chair, a cooler of cold ones, and a 12 pack of moon pies and I’m gonna watch this good ol’ fashioned mud slinging contest.

All this news about HD sales being down year over year interests me much less than the present kerfuffle.

Touch gloves. . .FIGHT!

Full disclosure in case we are going to start a betting pool, I think TJ is probably pretty accurate in his analysis.

Does riding a Sportster and living in a single wide on handouts, count are retirement? 🙂

I think TJ is a cheerleader whose so threatened by other companies success he resorts to creating his own acronyms. At least the orange and black pom poms don’t clash with the corporate logos on his bandana, t-shirt, saddle shoes and skirt!

Good for you Chris?

@BobS, that was pretty good. I especially like the saddle shoes reference. Well played. I’m running out of moon pies. Who’s next?

C’mon, sounds like a bunch of 9th grade girls having a cat fight on Twitter. We don’t come here for that.

LMAO Does riding a Sportster and living in a single wide on handouts, count are retirement? HELL YAH especially if you no wheels attached , a rat bagger and obomacare!!

Polaris will nibble away at HD like they always do in other segments they have products in

Who knows might be like old days HD Indian and a few others fighting it out for the kings throne in the cruiser market??

Like i once heard when i a lil kid, no body tattoos Honda on their body……HD does truly have a very unique brand loyalty ……….

Just too many choices out there and the market is getting more fragmented every year

Actually I think T.J. is partly right

H-D is the King of heavyweight cycles

and because of the mystique/marketing or whatever you want to call it

they will be, for a while longer.

But as the story (& the comments) show

& what has been said by me & other on this very blog,

every single time these reports come out, the market IS changing.

And both Polaris brands ARE having an effect .

H-D buyers/ loyalists ARE getting older & that share of the U.S. market is shrinking

with everyone who says “I’m done” or “I can’t hold it up anymore” or “I’m too old” or just dies off

Hence the push at minorities, women & overseas

Personally, I think H-D’s best days are behind them

& if they don;t come up with some serious tech innovations,

they will lose more market share to the Polaris brands.

(My next, and probably last bike, will either be a Vic. XC Tour or an Indian Roadmaster

I just have not decided on which one, yet )

I’m on a Indian Vintage right now and plan on adding a Victory Magnum X1 in the near future so I contributed to the lower profits. Might be a good time to build some new bikes (totally new bikes not the bold new graphic B.S. you’ve been selling for 30 years) and change your business plan.