This morning before the opening bell, Harley-Davidson reported its second quarter 2015 earnings results. Results are in line with company lower expectations following Harley-Davidson’s decision in April to lower motorcycle shipments from initial projections for 2015 in light of currency-driven competitive pressures in the U.S. and the company’s commitment to manage supply in line with demand.

This morning before the opening bell, Harley-Davidson reported its second quarter 2015 earnings results. Results are in line with company lower expectations following Harley-Davidson’s decision in April to lower motorcycle shipments from initial projections for 2015 in light of currency-driven competitive pressures in the U.S. and the company’s commitment to manage supply in line with demand.

Harley-Davidson Inc.’s stock HOG surged 2.8% in premarket trade this Tuesday July 21, 2015, after the motorcycle maker beat Wall Street profit and sales expectations. (The stock had tumbled 17% year to date through Monday, while the S&P 500 had gained 3.4%)

Harley-Davidson, Inc. (NYSE: HOG) second-quarter 2015 diluted earnings per share were $1.44 compared to EPS of $1.62 in the year-ago period. Second-quarter net income was $299.8 million on consolidated revenue of $1.82 billion compared to net income of $354.2 million on consolidated revenue of $2.00 billion in the year-ago period. Second-quarter results are in line with company expectations following Harley-Davidson’s decision in April to lower motorcycle shipments from initial projections for 2015 in light of currency-driven competitive pressures in the U.S. and the company’s commitment to manage supply in line with demand.

![]() Dealer new motorcycle sales were down 1.4 percent worldwide for the second quarter compared to the year-ago period, but gained momentum as the quarter progressed.

Dealer new motorcycle sales were down 1.4 percent worldwide for the second quarter compared to the year-ago period, but gained momentum as the quarter progressed.

“In the face of a tough competitive environment, driven mostly by currency and greater competitive activity, we are leveraging our many strengths and meeting the challenge head on,” said Matt Levatich, President and Chief Executive Officer, Harley-Davidson, Inc. “Our actions during the quarter have had a positive impact. We are encouraged by the momentum at retail as the quarter progressed, both in the U.S. and internationally.”

“We are confident in the strength of our business and the strategies we have in place to maintain our industry leadership and grow our business over the long term,” said Levatich. “Our singular focus on the customer through unrivaled products, unique experiences and our expanding dealer network is the bedrock we are building on to continue to grow our reach and impact with customers across the globe.”

![]() Retail Harley-Davidson Motorcycle Sales.

Retail Harley-Davidson Motorcycle Sales.

Dealers worldwide sold 88,931 new Harley-Davidson® motorcycles in the second quarter of 2015 compared to 90,218 motorcycles in the year-ago quarter. In the U.S., dealers sold 57,790 new Harley-Davidson motorcycles in the quarter compared to sales of 58,225 motorcycles in the year-ago period.

In international markets, dealers sold 31,141 new Harley-Davidson motorcycles during the second quarter compared to 31,993 motorcycles in the year-ago period, with sales up 16.6 percent in the Asia Pacific region and down 8.9 percent in the EMEA region, 2.6 percent in the Latin America region and 9.9 percent in Canada.

![]() Harley-Davidson Motorcycles and Related Products Segment Results

Harley-Davidson Motorcycles and Related Products Segment Results

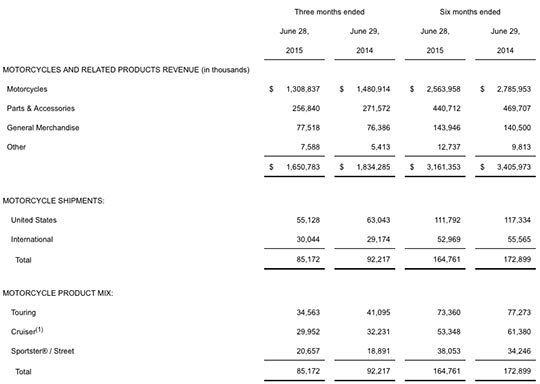

Operating income from motorcycles and related products (the “motorcycles segment”) decreased 19.6 percent to $380.6 million during the quarter compared to operating income of $473.3 million in the year-ago period. Operating income in the quarter was impacted primarily by lower motorcycle shipments and unfavorable foreign currency exchange.

Second-quarter revenue from motorcycles decreased 11.6 percent to $1.31 billion compared to revenue of $1.48 billion in the year-ago period. The company shipped 85,172 motorcycles to dealers and distributors worldwide during the quarter compared to shipments of 92,217 motorcycles in the year-ago period, in line with guidance.

Revenue from motorcycle parts and accessories was $256.8 million during the quarter, down 5.4 percent, and revenue from general merchandise, which includes MotorClothes® apparel and accessories, was $77.5 million, up 1.5 percent compared to the year-ago period.

Gross margin was 39.2 percent in the second quarter of 2015 compared to 39.5 percent in the second quarter of 2014. Second-quarter operating margin for the motorcycles segment was 23.1 percent compared to operating margin of 25.8 percent in last year’s second quarter.

Year-to-date in 2015, dealers sold 145,592 new Harley-Davidson motorcycles worldwide compared to 147,633 motorcycles in the year-ago period, with retail unit sales down 0.7 percent in the U.S., up 7.8 percent in the Asia Pacific region, and down 7.7 percent in the EMEA region, 1.2 percent in the Latin America region and 4.8 percent in Canada compared to the year-ago period.

Through six months, the company shipped 164,761 motorcycles to dealers and distributors worldwide, a 4.7 percent decrease compared to the year-ago period. Six-month revenue from motorcycles was down 8.0 percent to $2.56 billion, revenue from parts and accessories decreased 6.2 percent to $440.7 million and revenue from general merchandise increased 2.5 percent to $143.9 million compared to the first six months of 2014. Gross margin through six months was 39.1 percent, and operating margin was 23.0 percent compared to 38.6 percent and 24.1 percent respectively in the year-ago period.

![]() Financial Services Segment Results

Financial Services Segment Results

Operating income from financial services was $81.9 million in the second quarter of 2015, a 10.0 percent increase compared to operating income of $74.4 million in last year’s second quarter. Second-quarter financial services results reflect higher net interest income. Through six months, operating income from financial services was $146.6 million compared to operating income of $137.6 million through six months of 2014. The company previously indicated it expected operating income from financial services to be down modestly in 2015, but now expects operating income to be up modestly compared to the prior year.

Harley-Davidson continues to expect to ship 276,000 to 281,000 motorcycles to dealers and distributors worldwide in 2015, an approximate 2 percent to 4 percent increase from 2014. In the third quarter, the company expects to ship 54,000 to 59,000 motorcycles compared to 50,670 motorcycles shipped in the year-ago period. The company continues to expect full-year 2015 operating margin of approximately 18 percent to 19 percent for the motorcycles segment. The company also continues to expect 2015 capital expenditures for Harley-Davidson, Inc. of $240 million to $260 million.

Motorcycles And Related Products Revenue And Motorcycle Shipment Data

Worldwide Retail Sales Of Harley-Davidson Motorcycles

What about the Indian & Victory competition?

You’ve got to love Wall Street. Because it’s less worse than anticipated the stock jumps… It’s still bad results.

Johny: Most companies don’t typically reference their competition specifically in their sales and earnings report but the phrase “greater competitive activity” could be translated as referencing them indirectly.

Who is the customer base? Walk around a dealership and see. White middle aged males. Same core customer base as before except now it is the sons of baby boomers who are approaching middle age. We don’t like hipster marketing, dark custom interpretations of classics like the Wide Glide or tee shirts made in God knows where. I’m not the only forty something with some disposable income turning into my father. I am tired of seeing our manufacturing base being outsourced and hollowed out. You pay more to get less for everything nowdays.

If Harley focused on building bikes for their core customer base and quit diluting the brand with made in Taiwan billet parts or hawking wedding cake knives and dog bandannas, the loyalty would return. Not everything has to be computerized in this world and hi tech to the nth degree either so if a sensor goes out, someone is stuck waiting on the tow truck. Let’s have a company that leans towards the older ways and quits trying to market to kids with cheaper products. Make fewer bikes, increase the quality and watch the customers respond. Also, there shouldn’t be a small special “Made in USA” section of dealer tee shirts. That is insulting. Customers are going to push back against political correctness, “change”, and diversity more and more.

Until Harley turns around, consider paying your local shop to build or help you build a bike using S&S and custom parts and you will have pride in ownership and people will be able to pick your bike out of the crowd.

Harley’s share of the U.S. market for heavyweight motorcycles, those with engines of 601 cubic centimeters or greater, skidded to 47.5% in the second quarter from 50.3% a year earlier. That compares with a peak of 58% in the final quarter of 2013.

One factor, Harley said, is the inclusion in market-share data of new three-wheeled vehicles resembling cars, such as the Slingshot from Polaris Industries Inc. Harley doesn’t make a similar vehicle.

Pricing is the bigger issue. Harley fears it would destroy its profit margins and premium brand image if it slashed prices to match those of rivals.

Looks just like the big 3 in Detroit and we know where that is getting them !

They should build what the market needs and not jam dealers with those 500-750 cc bikes ….their nothing but dead stock in dealers inventory.

RE:

“…Who is the customer base?…”

Good question.

However, more to the point….. How big is that constituency…???

You can have a real loyal following, but if there’s only 10 of-em you still won’t have a business case.

RE:

“…jam dealers with those 500-750 cc bikes…”

Well, lets see now the XR750 is a fairly cool scooter.

If the customer base will be populated with the kids that are trading up from BMX bicycles to motor bikes…. Affordable 750 sportsters with a wall full of after market goodies to turn-em into street trackers might not be such a bad idea.

Now if some enterprising individual would come up with after market XR cylinder heads with flat slide carbs and some high pipes that might be the ticket to luring a new generation of youngsters into the showroom.

Stuff like that and one of Mert’s cool racing chassis and they might even get an old fart like me to jump in……. Light, short, & nibmle is starting to look better & better…….. 🙂

-nicker-

Nicker I guess with the X games ect they can and are trying to develop a market …………like the 48 and other fat tired sporties did for the model