If you already know and understand the basics of car insurance coverage, you’re in good shape to know the basics of motorcycle insurance coverage. But there are some differences between motorcycle and car insurance. Motorcycle insurance, which is required in nearly every state, helps to protect the owners’ investments in cases of collisions, theft, injury, and much more.

If you already know and understand the basics of car insurance coverage, you’re in good shape to know the basics of motorcycle insurance coverage. But there are some differences between motorcycle and car insurance. Motorcycle insurance, which is required in nearly every state, helps to protect the owners’ investments in cases of collisions, theft, injury, and much more.

What do motorcycle and auto insurance policies have in common?

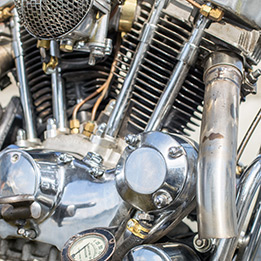

A good rule of thumb: if specific coverage is required for auto insurance in any particular state, the same will generally be true of motorcycle insurance. Even in states that don’t require motorcycle insurance, coverage options are normally quite similar to those offered on auto policies. Liability, uninsured motorist, medical payments, and physical damage coverage are fairly common coverages to see offered by motorcycle insurance providers.

Motorcycle Liability Coverage

As is the case with car insurance, liability coverage is extremely important, as it covers the other driver and the other vehicle and property in the event that you cause a collision. This is the minimum type of motorcycle coverage required by most states.

While motorcycle riders are less likely to cause as much damage as an automobile, strictly considering the weight of the vehicle, riders are still liable for damage and injury that they cause to a third party. Further, lawsuits don’t discriminate based on what sort of vehicle the liable party was driving (or, in this case, riding). If you caused an accident, you expose yourself to a potential lawsuit. Since liability coverage is intended to protect the primary named insured’s assets, carrying as much liability as you can afford is always the best option. Pro Tip: Increasing liability limits on a motorcycle policy is fairly inexepensive, so maxing out your coverage will generally result in a very small, if any, increase in premium.

Uninsured Motorist and Medical Payments Coverage for Motorcycle Owners

Having both medical and uninsured motorist coverage broadens the scope of an insurance policy to cover the rider in a more comprehensive manner. Uninsured drivers are a big problem for car owners and motorcycle owners alike. Uninsured motorist coverage keeps you (the rider) and your bike protected in the case that you’re hit, injured, or otherwise sustain damage caused by someone who is uninsured or underinsured. For motorcyclists especially, this type of coverage is critical. According to a study conducted by the Insurance Research Council (IRC), as of 2012, about one in eight drivers (more than 12%) was uninsured. And going without uninsured motorist coverage would mean your medical bills would not be covered in these all-too-frequent dangerous scenarios.

Where uninsured motorist coverage protects riders from other drivers who may be without insurance at the time of an at fault accident, medical payments coverage is intended to protect the rider when they suffer injury due to an accident that is considered their own fault. And even if you consider yourself a superb and safe driver and you’re more worried about the dangerous behavior of others on the road, you could be on the hook for major medical expenses if you forgo medical payments coverage and cause a collision.

Pro Tip: Uninsured motorist coverage amounts don’t have to match your liability limits if you choose to carry a higher amount of liability.

Motorcycle Full Coverage (for Physical Damage to the Bike)

Motorcycle Full Coverage (for Physical Damage to the Bike)

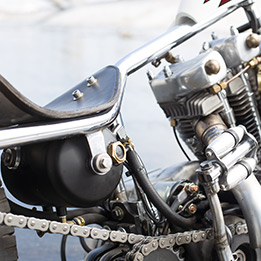

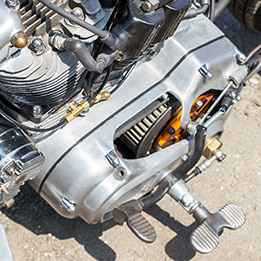

Physical damage coverage is extremely important to both auto and motorcycle owners as well; especially folks who are financing their cars or cycles. When signing the loan paperwork for that sweet new Harley or Indian or…, your salesperson will undoubtedly mention the fact that you will need insurance coverage to take the bike home. What they really mean is that, while you’re making payments on it, the motorcycle will need to be protected against damage and theft — not just liability. Fortunately, motorcycle owners can select deductible options similar to those available to automobile owners.

Pro Tip: Physical damage coverage can be a bit expensive for motorcycles due to the likelihood of damage and theft, so ask your salesperson about the highest deductible your finance company will allow you to carry. The higher the deductible, the lower the premium.

What’s the difference between motorcycle insurance and car insurance?

As you’ve seen above, motorcycle and auto insurance overlap in a number of ways, but here are a few types of insurance coverage unique to those choosing the motorcycle life: Continue reading ‘Motorcycle Versus Car Insurance’

While golfing, I accidentally overturned my golf cart. A very attractive golfer who lived in a villa on the golf course, heard the noise and called out, “Are you okay?” “I’m okay, thanks,” I replied as I pulled myself out of the twisted cart.

While golfing, I accidentally overturned my golf cart. A very attractive golfer who lived in a villa on the golf course, heard the noise and called out, “Are you okay?” “I’m okay, thanks,” I replied as I pulled myself out of the twisted cart.