1- Change Of US Leadership Makes Predicting Anything Much More Complicated. Americans can’t recall a time when a change of leadership in Washington had the potential for such large and diverging effects on the U.S. economy. If you believe that the economy is going to be stimulated through new legislation and less regulation, for example by lowering individual and corporate taxes, with a tax holiday offering incentive for repatriation in the US of profits kept abroad by multinational corporations, by the rebuilding of America’s infrastructure to create a large number of construction jobs, etc… you can expect discretionary purchases to increase, and consequently the motorcycle industry to get a boost. American motorcycle manufacturers would benefit if the consumer has extra cash and borrowing costs remain quite low. Of course, if the US doesn’t get involved in a trade war which would create inflationary pressure on the imported products we all consume.

1- Change Of US Leadership Makes Predicting Anything Much More Complicated. Americans can’t recall a time when a change of leadership in Washington had the potential for such large and diverging effects on the U.S. economy. If you believe that the economy is going to be stimulated through new legislation and less regulation, for example by lowering individual and corporate taxes, with a tax holiday offering incentive for repatriation in the US of profits kept abroad by multinational corporations, by the rebuilding of America’s infrastructure to create a large number of construction jobs, etc… you can expect discretionary purchases to increase, and consequently the motorcycle industry to get a boost. American motorcycle manufacturers would benefit if the consumer has extra cash and borrowing costs remain quite low. Of course, if the US doesn’t get involved in a trade war which would create inflationary pressure on the imported products we all consume.

One of the biggest winners since the election has been the U.S. dollar rising sharply against all major foreign currencies. It means that in the US, Harley-Davidson and Polaris may face a tougher price competition from direct or indirect competitors like Triumph, Ducati, BMW, Royal Enfield, etc taking advantage of their lower home currency to offer much cheaper models. During the next 2 years the US motorcycle market is expected to remain somewhat stagnant or increasing only in the very low single digit. Harley-Davidson – much more than Polaris Motorcycles Division – relies on exportation to grow its unit sales. Would a slightly better demand in the US compensate for sales loss abroad due to a higher dollar? The introduction of the H-D LiveWire electric model susceptible to attract new motorcycle buyers being 2 or 3 years away, and in the absence of truly new affordable models, it could be a very challenging next 2 years for Harley’s domestic and global sales. Regarding the custom parts industry, the upcoming new administration is floating the idea of a 5% tariff on all imported goods. Most of custom motorcycle parts sold in the US being manufactured abroad, even when conceived here locally, it could spell trouble for many aftermarket part vendors and distributors, and this even if corporate taxes are lowered from 35% to 20%.

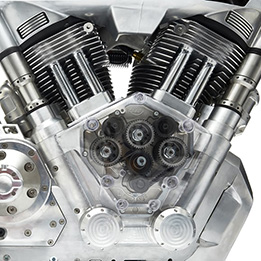

2- The Disrupted US Motorcycle Industry. Since 2013, when Polaris resurrected the Indian Motorcycle nameplate, it has been a kind of David versus Goliath competitive environment. Harley-Davidson is not a tarnished brand, is not in financial trouble and is not going to be dethroned by Polaris 2 motorcycle brands in just a few years. But at the end of 2012, Harley owned 57.2% of the heavyweight motorcycle market over 601 cc and larger. By the end of 2015 that had shrunk to 50.2%, even as that segment of the market expanded from 62% of the total U.S. motorcycle market – in terms of new units registered – to 85%. Harley-Davidson unit sales have fallen for 8 straight quarters since Indian Motorcycle was relaunched. During that time Polaris motorcycle sales were up 67%, a very significant market gain almost essentially at the expense of its Milwaukee competitor. While the motorcycle market isn’t getting much bigger, it’s just being divided up differently. Indian started from scratch, so its growth will naturally seem exponential while Harley, as the more mature motorcycle maker, will appear to be growing much slower if any. It’s true that far more bikers still buy from Harley, but although Polaris is very secretive when it comes to publishing unit sales per brand and model, it is certain that an increasing number of riders are choosing Indian or Victory motorcycles. Polaris success is that in very short years it was able to offer all across the bike size spectrum alternate very competitive models in terms of performance and at great price points.

2- The Disrupted US Motorcycle Industry. Since 2013, when Polaris resurrected the Indian Motorcycle nameplate, it has been a kind of David versus Goliath competitive environment. Harley-Davidson is not a tarnished brand, is not in financial trouble and is not going to be dethroned by Polaris 2 motorcycle brands in just a few years. But at the end of 2012, Harley owned 57.2% of the heavyweight motorcycle market over 601 cc and larger. By the end of 2015 that had shrunk to 50.2%, even as that segment of the market expanded from 62% of the total U.S. motorcycle market – in terms of new units registered – to 85%. Harley-Davidson unit sales have fallen for 8 straight quarters since Indian Motorcycle was relaunched. During that time Polaris motorcycle sales were up 67%, a very significant market gain almost essentially at the expense of its Milwaukee competitor. While the motorcycle market isn’t getting much bigger, it’s just being divided up differently. Indian started from scratch, so its growth will naturally seem exponential while Harley, as the more mature motorcycle maker, will appear to be growing much slower if any. It’s true that far more bikers still buy from Harley, but although Polaris is very secretive when it comes to publishing unit sales per brand and model, it is certain that an increasing number of riders are choosing Indian or Victory motorcycles. Polaris success is that in very short years it was able to offer all across the bike size spectrum alternate very competitive models in terms of performance and at great price points.

In addition, brands like Triumph, Ducati and Royal Enfield are aggressively pushing their bikes in the US. Triumph got strong traction with good sales of its “modern classics”, the Bonneville, the Thruxton and now the Bonneville Bobber model. Ducati perceived here during a long time as a Moto GP racer decked out in sponsor badges now offers city streets models and is also quite successful with its very affordable 6 Scrambler products . And India-based Royal Enfield recently established its North American headquarters in Milwaukee’s Third Ward and hired a former Harley-Davidson executive as North American division president. And let’s not forget that younger bikers (read below), as opposed to Boomers, are more interested by product value than image. As it’s often the case in such a disrupted market, being the leader manufacturer, Harley has more to lose when the consumer choice is much wider with quality products equal or sometime better for performance and offered at competitive prices. There are not yet definitive winners or losers in this brands battle, but for sure bikers will continue to benefit.

3- Cracking The Millennials Code With New Marketing And New Motorcycle Models. We are in a graying/whitening market with a large number of Boomers riding off into the sunset after each motorcycle rally. In the US, population aged 50+ is currently north of 100 million, and will reach 173 million by 2060. According to MIC (Motorcycle Industry Council) the median age of the typical motorcycle owner in 1990 was 32, and was a married male who had a high school diploma. Today, the typical owner got at least some college education. But the median age has climbed significantly to 49 years old. Only 17% of riders today are under 30, compared to 41% 25 years ago. Regarding age, these numbers are certainly worse if you address specifically the heavyweight motorcycle market in which Harley and Polaris are competing. In 2020 Millennials are going to comprise 49% of the work force and will replace Boomers as the biggest spenders and borrowers. The oldest Millennials (born in 1980) are 36 years old. Although they have more education loan debts than Boomers, the oldest already earn more than their parents did at the same age. Individual earnings always peaking between the age of 34 and 52, they are the human force that will decide the success of most corporations, in and out of the motorcycle industry, for at least the next 20 years. Continue reading ‘What Will Be Trending In 2017’

3- Cracking The Millennials Code With New Marketing And New Motorcycle Models. We are in a graying/whitening market with a large number of Boomers riding off into the sunset after each motorcycle rally. In the US, population aged 50+ is currently north of 100 million, and will reach 173 million by 2060. According to MIC (Motorcycle Industry Council) the median age of the typical motorcycle owner in 1990 was 32, and was a married male who had a high school diploma. Today, the typical owner got at least some college education. But the median age has climbed significantly to 49 years old. Only 17% of riders today are under 30, compared to 41% 25 years ago. Regarding age, these numbers are certainly worse if you address specifically the heavyweight motorcycle market in which Harley and Polaris are competing. In 2020 Millennials are going to comprise 49% of the work force and will replace Boomers as the biggest spenders and borrowers. The oldest Millennials (born in 1980) are 36 years old. Although they have more education loan debts than Boomers, the oldest already earn more than their parents did at the same age. Individual earnings always peaking between the age of 34 and 52, they are the human force that will decide the success of most corporations, in and out of the motorcycle industry, for at least the next 20 years. Continue reading ‘What Will Be Trending In 2017’

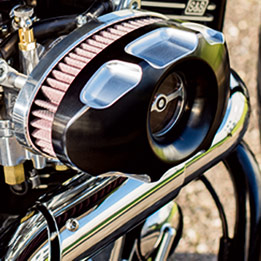

Carl Brouhard Designs has developed yet another line of parts with some cutting art machined in them. The Spiro Series features a unique design with lines that seem to interweave on each part. All parts are available in Chrome or Black with offset cut.

Carl Brouhard Designs has developed yet another line of parts with some cutting art machined in them. The Spiro Series features a unique design with lines that seem to interweave on each part. All parts are available in Chrome or Black with offset cut.